Recent economic turbulence and the ongoing cost-of-living crisis have highlighted the importance of financial resilience for many households. While the allure of high returns might be tempting, it’s crucial to remember that even small amounts can be invested wisely over time, even if you have limited resources.

This article will highlight practical strategies for those looking to start their investment journey and explore some of the most accessible methods you could choose to pursue.

Investing Strategies for People with a Limited Budget

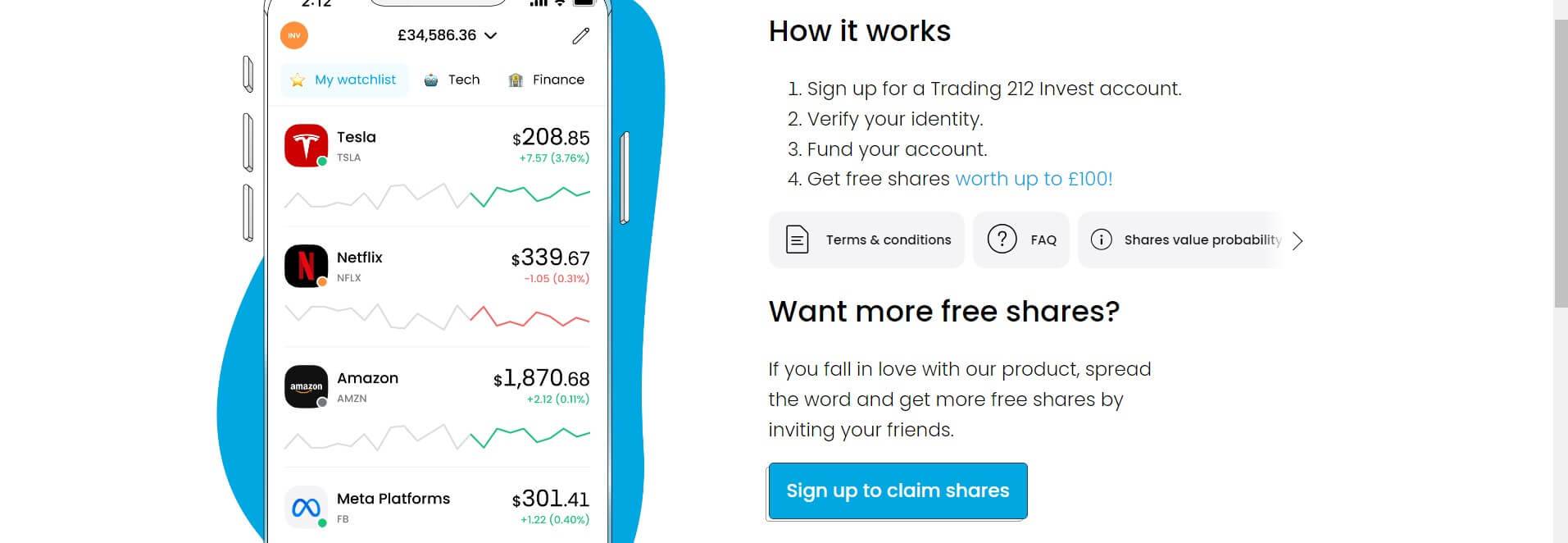

Start Small With Micro-investing Apps

One of the most accessible ways to take your first steps into the world of investing is through micro-investing apps. These platforms allow you to invest small amounts regularly, often rounding up your purchases to the nearest pound. This understated approach to saving can accumulate over time, providing a foundation for your investment portfolio.

It’s worth noting that while these apps can be a great starting point, they often come with small transaction fees. It’s essential to understand the charges involved before committing.

Leverage pound-cost averaging

Pound-cost averaging is a strategy where you invest a fixed amount of money in a particular investment on a regular schedule, regardless of the share price. This method can help to reduce the impact of market volatility.

By investing consistently, you buy more shares when prices are low and fewer when they are high. Over time, this can help to lower your average cost per share. While it doesn’t guarantee profits, it can be a sensible approach for long-term investors.

Explore Diverse Investment Options

Diversification is key to managing investment risk. While it might seem counterintuitive with limited funds, there are ways to achieve this.

- Index funds and ETFs: These funds offer a low-cost way to invest in a wide range of assets. By investing in an index fund that tracks a broad market index, you gain exposure to multiple companies without the need for individual stock picking.

- Peer-to-peer lending: Platforms like this allow you to lend money to individuals or businesses in return for interest. It’s important to research platforms carefully and understand the risks involved.

- Crowdfunding: This method involves investing in small businesses or projects. While it can be risky, it also offers the potential for higher returns in the future.

For those interested in more active investment strategies, forex trading can be an accessible option even with a limited budget, as many brokers offer micro-lot trading. However, it’s crucial to understand the risks and invest in proper education before engaging in forex trading.

It’s important to remember that investing is a long-term game. Avoid chasing quick wins and focus on building a diversified portfolio that aligns with your financial goals and risk tolerance. Regular review and adjustments to your investment strategy are essential to ensure you maintain your financial health.

This post complies with my Disclosure Policy

Found this useful wondering how you can show me your appreciation? Well, there are some ways you can say thanks and support my website: ➡